Zillow Group announced it would make a full exit from its iBuying business on November 2. The company will wind down Zillow Offers, which it launched in earnest in late 2018, and reduce its staff of over 6,400 by 25 percent over the next several quarters.

The move shocked many in and outside the industry as the company had aggressively and publicly been reorienting itself around this new service since launching it three-and-a-half years ago when company co-founder and visionary Rich Barton jumped back into the CEO seat to help lead it.

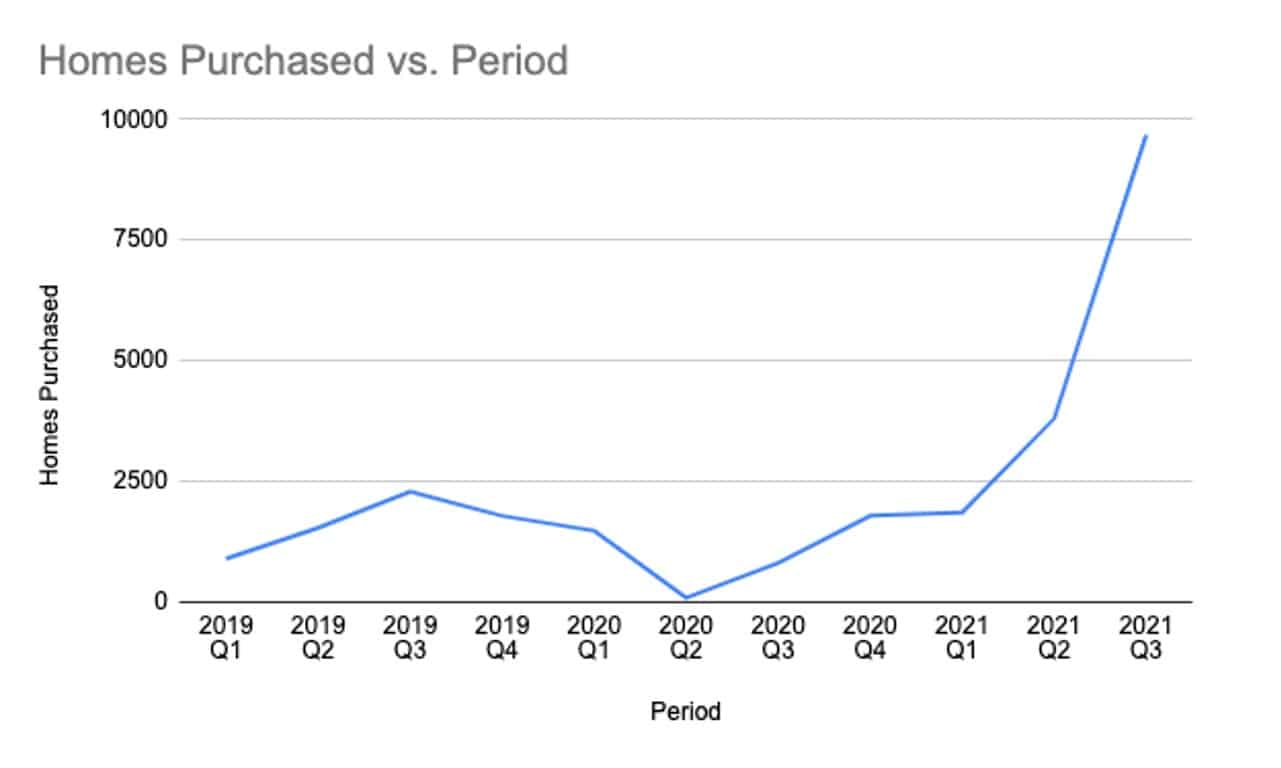

Zillow Group had gone big with Zillow Offers. In the third quarter 2021 it bought 9,680 homes in the quarter, more than twice it had in any other quarter.

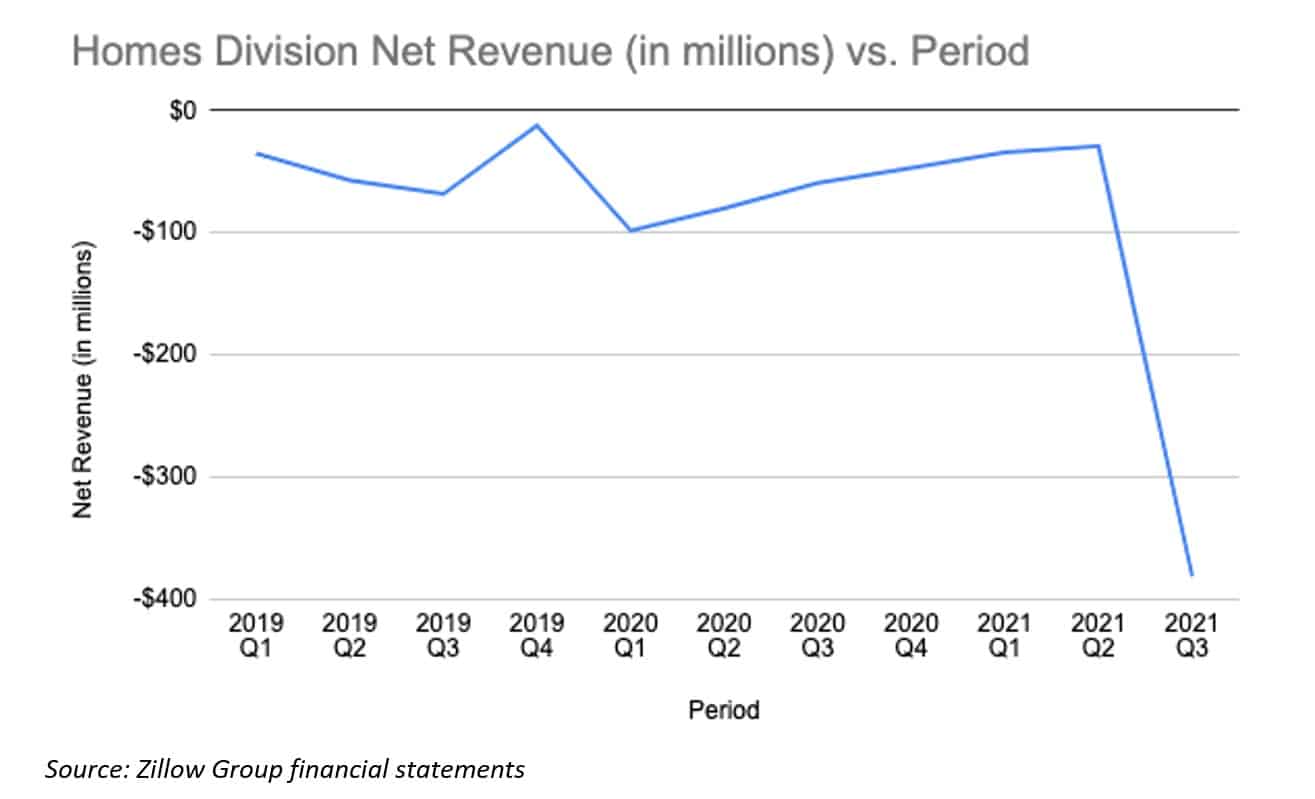

In its time operating Zillow Offers, the company lost a net of approximately $1 billion in its Homes division, under which the business operated. The Homes division lost $514.6 million in 2021 alone, $381 million in the third quarter.

Zillow Group Co-Founder Rich Barton itemized the reasons for the firm’s decision to walk away from iBuying on the its third quarter earnings call. The reasons he gave included:

- Volatility of home pricing

- The inability to model pricing at scale, in both directions

- Performance volatility and a high error rate

- Staffing and operations availability to fulfill needs

- Offers not compelling enough. Only roughly 10 percent of serious sellers accepted an offer when presented one by Zillow.

Alternative Financing

While iBuying represents a new real estate brokerage business model it also stands as just one part of the real estate financing revolution. This trend of alternative financing, or AltFin for short, has progressed beyond the capital- and risk-intensive practice of companies simply purchasing homes directly.

The benefits iBuying provides to sellers – certainty, convenience, simplicity – can be achieved in a variety of other ways, which many companies have introduced, including cash-backed offers on their next home via a home trade-in (if the sellers are buying another home) as Opendoor and Knock have introduced, guaranteed cash offers on their home (if the home does not sell on the open market) and discount, streamlined listing brokerage services.

The financing revolution has come for buyers, too. Companies such as Flyhomes and Homeward provide financing to buyers that allows them to present offers as all-cash.

The innovation and millions of dollars pouring into AltFin is mitigating the thorny challenges of financing and allowing sellers and buyers to more easily and quickly transact.

Some services, including Zavvie, Ribbon Homes, Knock and HomeLight, exclusively partner with third-party brokerages or agents to provide AltFin services. Others, like Opendoor and Offerpad look to provide more of these services to consumers directly (although these companies do work with third-party agents in some locations).

The potential upside as an actual purchaser of homes is big, so is the risk, and Zillow Group, as the charts above make clear, judged it too volatile and tricky to achieve at scale, the only way it could generate the margins to justify the business.

Zillow Group’s biggest iBuying competitors, Opendoor and Offerpad, had already introduced other AltFin services to diversify their models and lessen their exposure to the risk of solely purchasing homes and reselling them. For example, they both offer home trade-ins and in-house brokerage services.

Barton mentioned in Zillow Group’s third quarter earnings call that it would explore some of the other less capital-intensive AltFin services other companies have been pioneering.

Barton emphasized the company firmly continues its big bet on stitching together a one-stop digital real estate experience for consumers that includes shopping, connecting, selling, buying financing and closing in a single service it calls Zillow 360. The components Zillow built in conjunction with its Offers business – such as Zillow Home Loans and Zillow Closing Services – will play key parts in this vision.

For more an in-depth analysis on the AltFin revolution, read the 2022 Swanepoel Trends Report chapter, “The Real Estate Financing Revolution.” Get a copy of the report here.